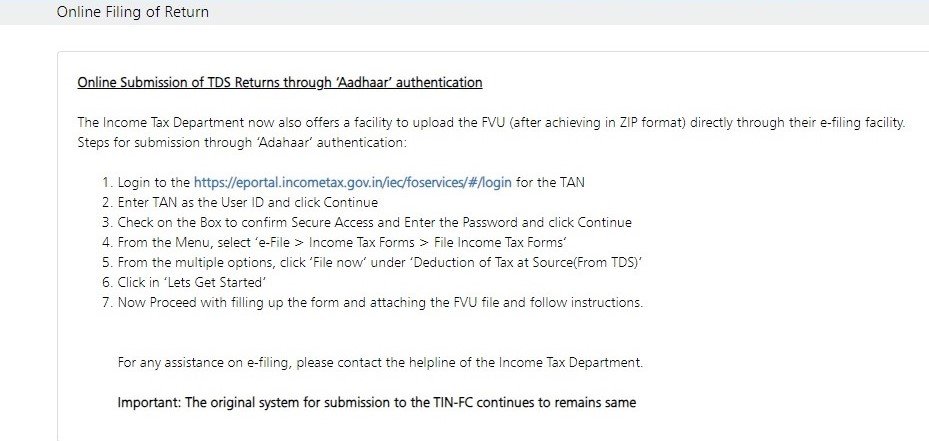

Online Submission of TDS Returns through ‘Aadhaar’ authentication

The Income Tax Department now also offers a facility to upload the FVU (after achieving in ZIP format) directly through their e-filing facility.

Following are the steps for submission through ‘Aadhaar’ authentication:

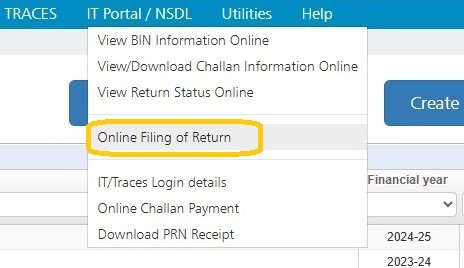

Click on >Online Filing of Return< under >IT Portal/NSDL<

The following screen will appear:

In order to proceed, click on www.incometaxindiafiling.gov.in as mentioned above.

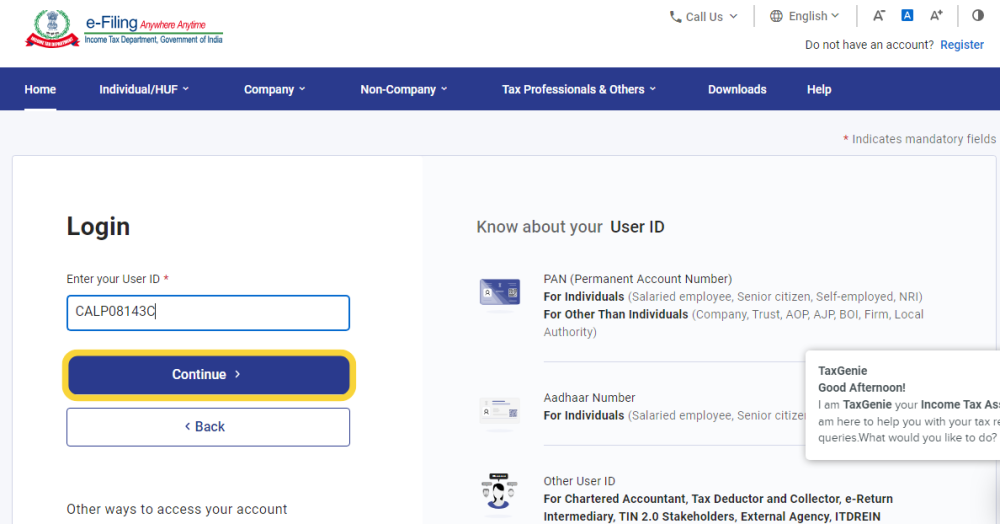

This will open the Income Tax Portal in a new window. The following screen will appear:

User ID – In order to Log In, enter the >User ID< as registered with the department.

Click on >Continue<

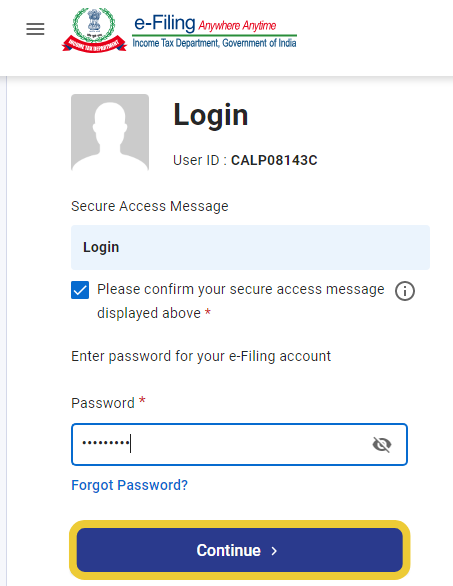

The following screen will appear:

Password – Enter the >Password<

Click on >Continue<

The following screen will get displayed:

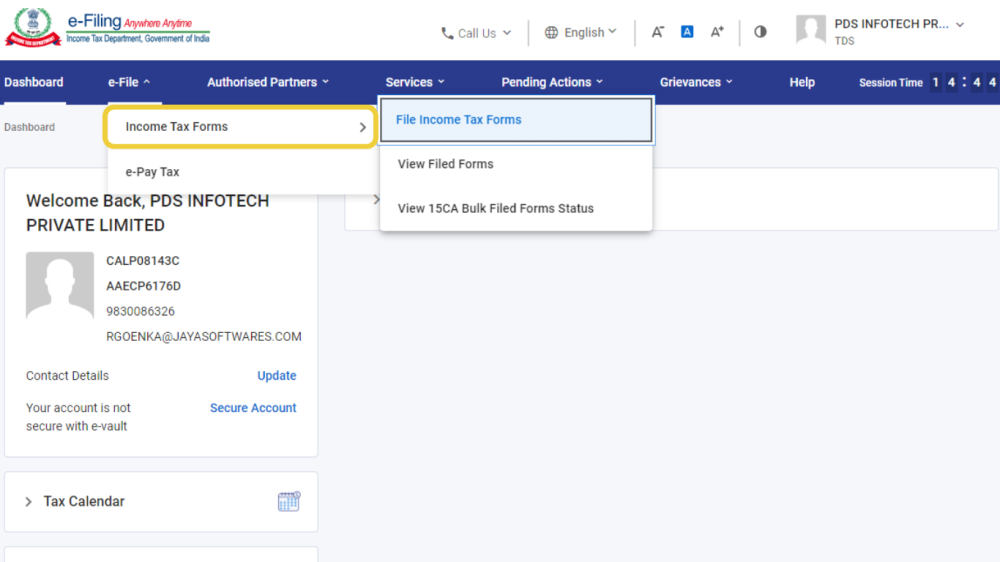

Select the option >Services< from the navigation bar and click on >File Income Tax Forms<

then click on >Income Tax Forms<

The following screen will appear:

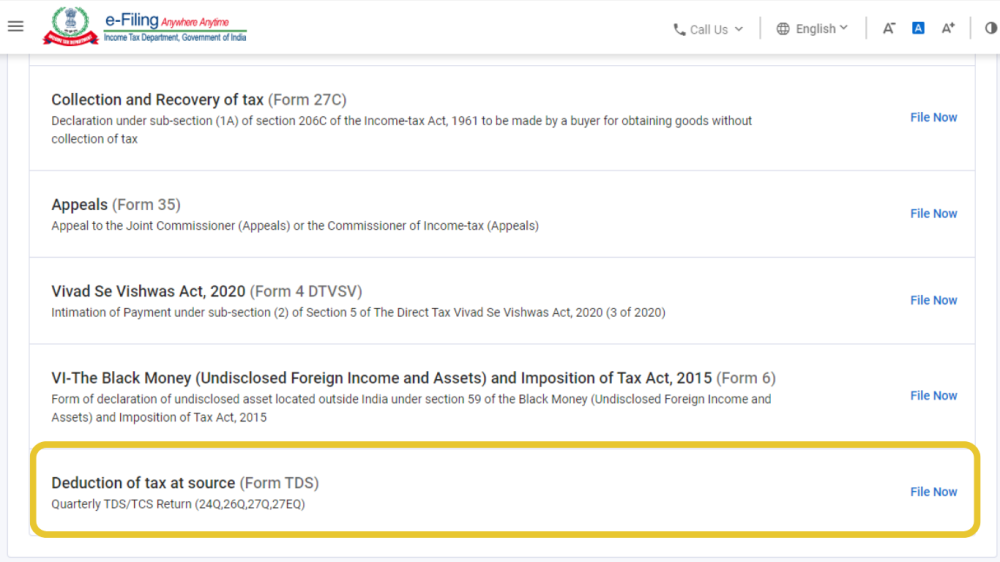

Now select the option >Deduction of Tax at Source< and click on >File Now<

The following screen will appear:

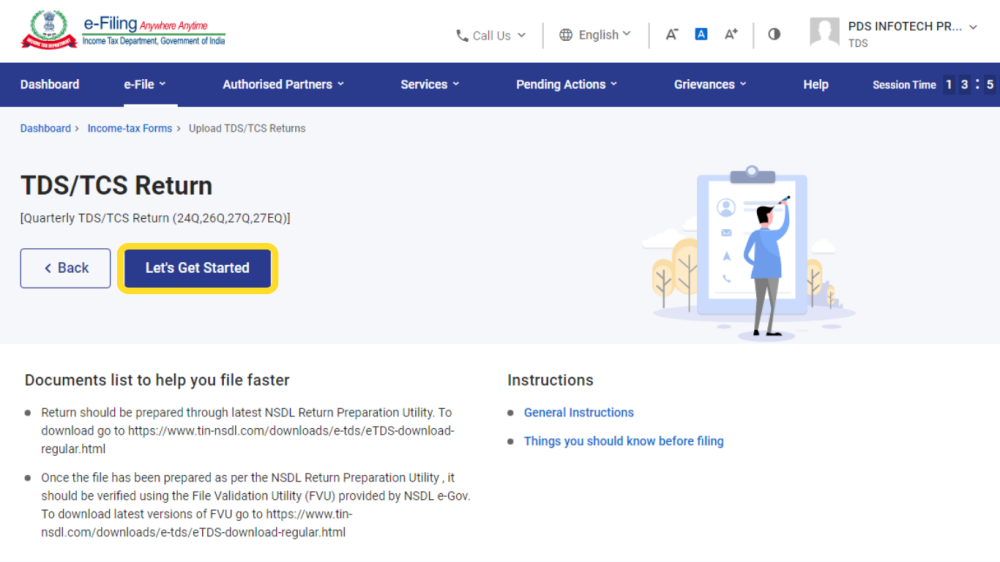

Click on >Let’s Get Started<

The following screen will appear:

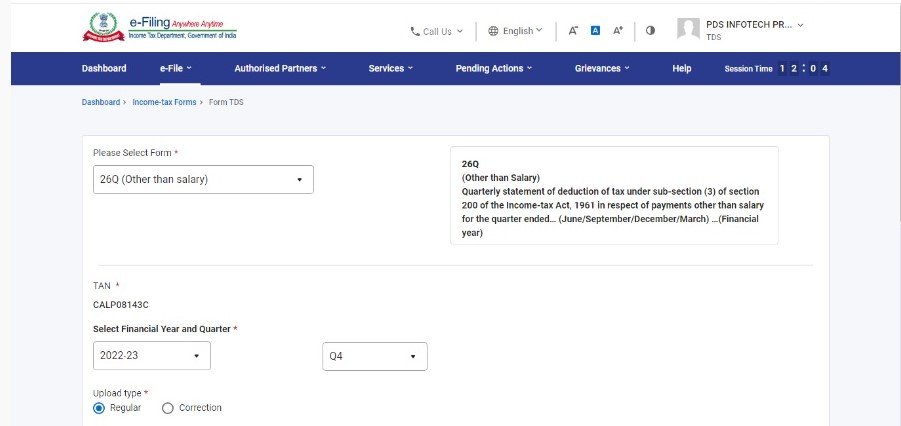

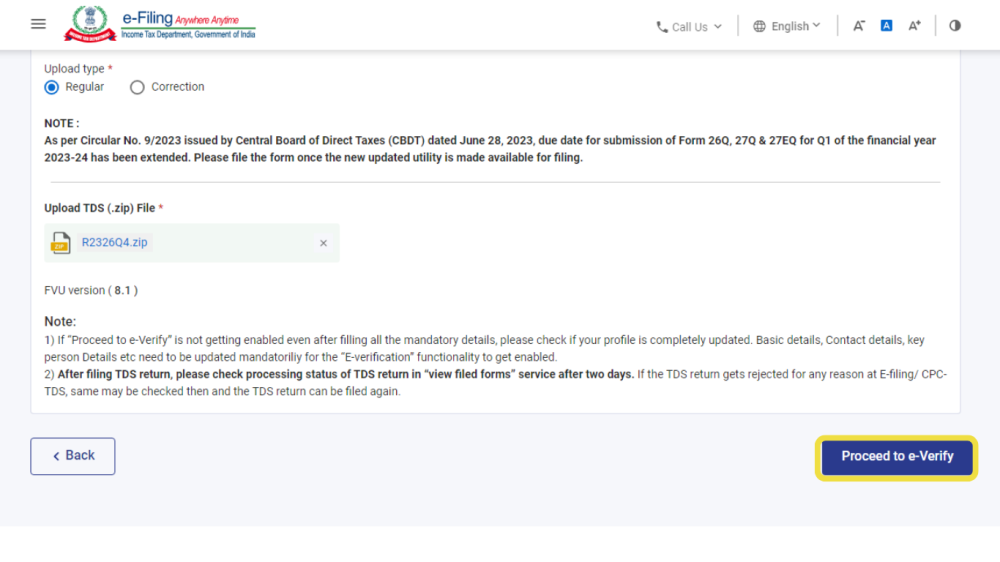

The above screens displays blank fields that need to be entered correctly

>Form< – Select the correct Form number for which the Return needs to be filed

>Quarter< – Select the Quarter

>Upload Type< – Select the upload type (Regular Return / Correction Return)

>Upload TDS< – Upload the FVU file in ZIP format

After uploading the FVU ZIP File, click on >Proceed to E-verify<

The following screen will get displayed:

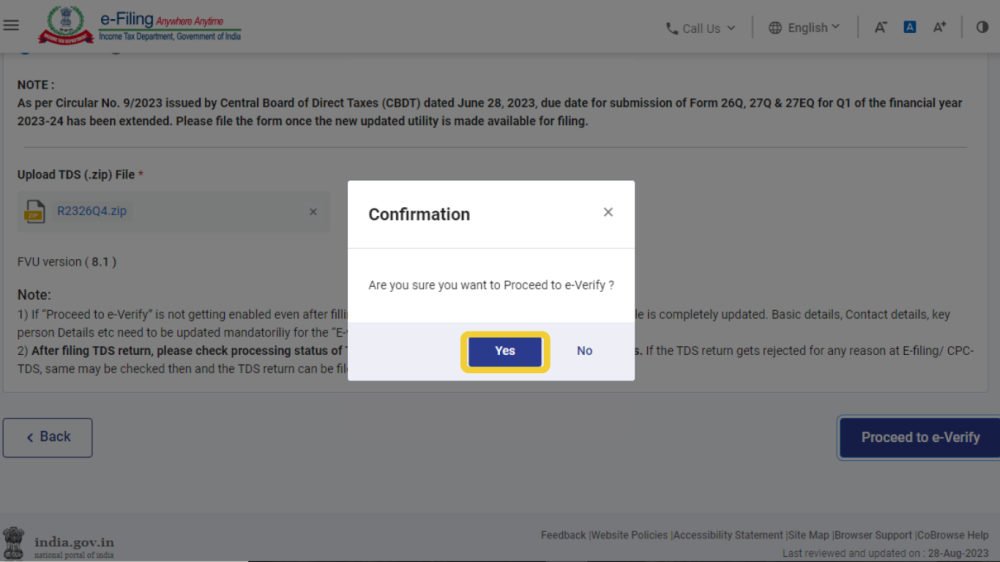

In order to proceed to E-verify, click on >Yes<

The following screen will appear:

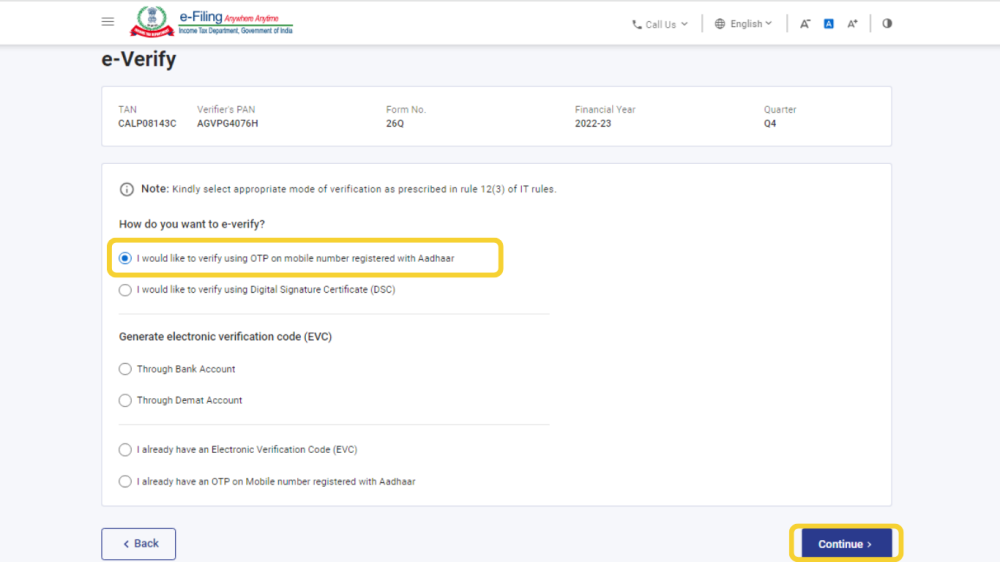

To generate the OTP through Aadhaar, click on >I would like to verify using OTP on mobile number registered with Aadhaar<

Click on >Continue<

The following screen will get displayed:

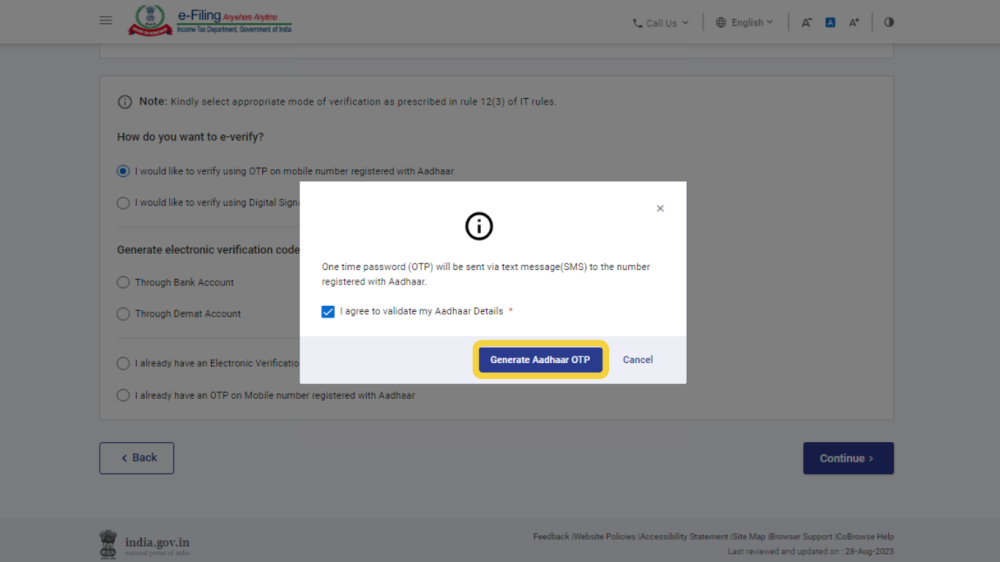

Click on >Generate Aadhaar OTP<

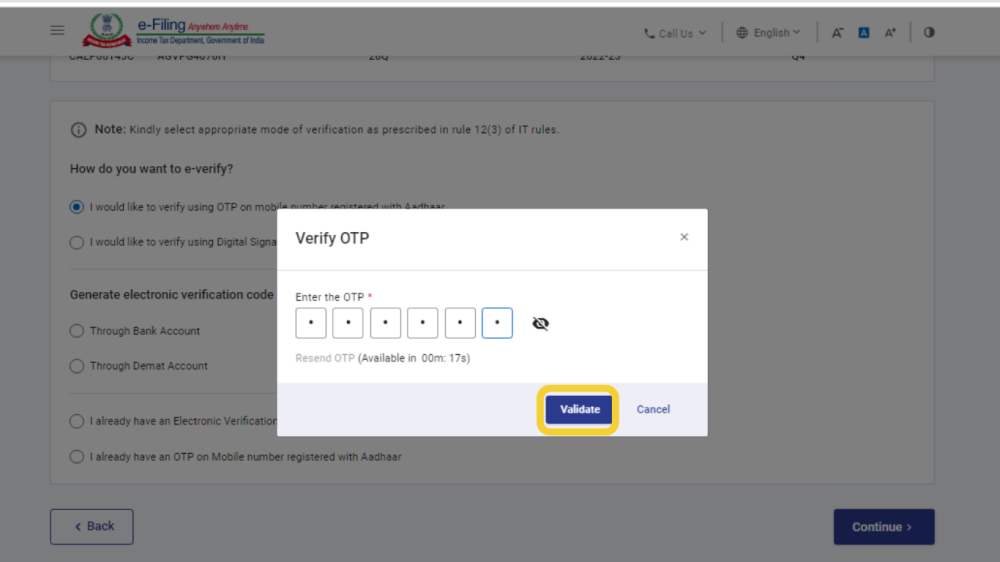

The following screen will get displayed:

The OTP will be sent to your registered mobile number. Enter the OTP and click on >Validate<.

Once the validation is done, your FVU File is successfully submitted to the department

Need more help with this?

TDSMAN Online - Support