TDS Returns are prepared by providing information on the tax deposited through Challan payment along with the corresponding breakups of the deductees. Make sure that Company Name, Quarter, Financial year & Form No. for which the return is being processed, is properly placed and visible in the screen, above of where all the steps are shown(refer to fig- 03 Regular Return).

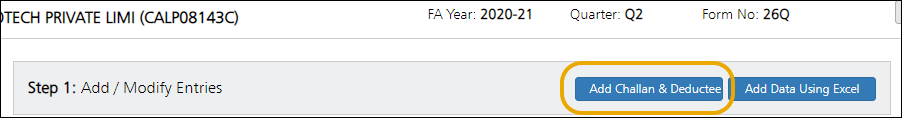

Click on <”Add Challan & Deductee”> option:

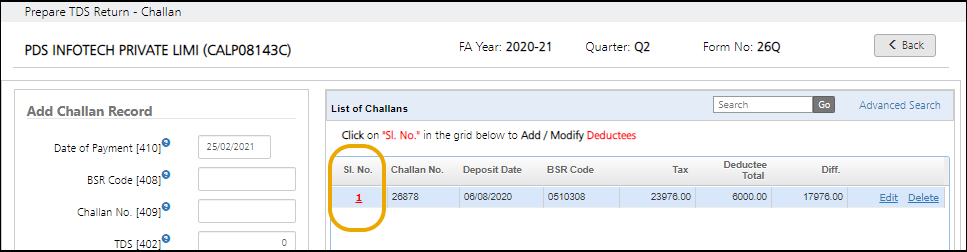

The following screen will be displayed:

In this section we concentrate on entering and maintaining all the Challan records, which have to be submitted. On the left section of the screen, Challan details needs to be entered.

As above screen you have to enter the followings:

- Date of Payment

- BSR Code

- Challan No.

- TDS

- Interest (Optional)

- Fee (Optional)

- Total

- Minor Head

After entering the details, click on Save and the records will be saved, and the new challan with new records will be added and displayed in the ‘list of Challans’ section. To enter the corresponding detail of employee deductions against each Challan, Click on SL NO as displayed below:

After clicking on ‘SL No’ The following screen will appear:

Now provide the Tax deduction details of the employees, corresponding to the selected payment Challan. The following employee details have to be entered: (refer to fig – 06 Regular Return)

- Employee Name

- PAN

- Code (Company/Non company)

- Section No.

- Date of Payment

- Amount

- Tax Deducted

The details of the Challan will get displayed in the right section of the screen.

After entering the details, click on Save to save the records. (refer to fig – 06 Regular Return).Similarly you can keep adding employees.

Need more help with this?

TDSMAN Online - Support