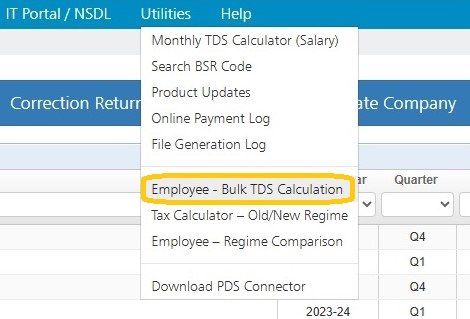

This feature is used to calculate the TDS amount for the employees. In order to do so, the user has to click on >Utilities->Employee- Bulk TDS Calculation , as shown below :-

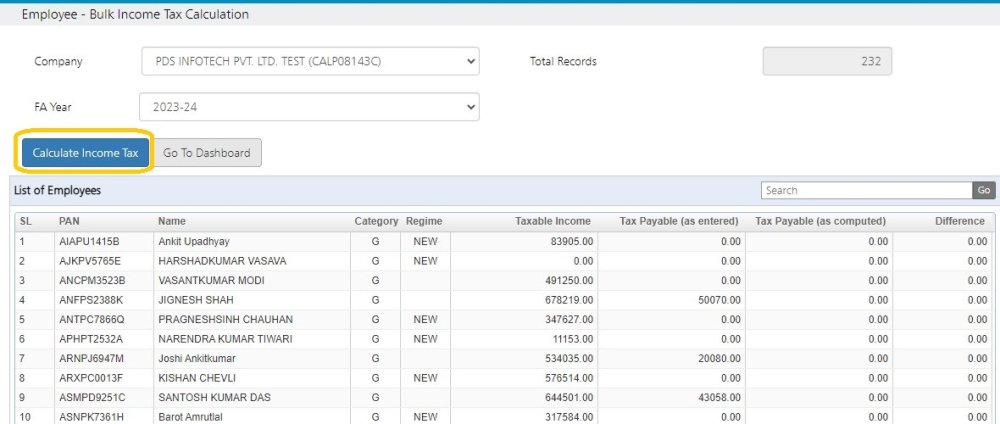

The following screen will get displayed:-

The user needs to select the company name and the Financial Year for which the TDS has to be calculated.

The total number of employees will get displayed.

Click on ‘Calculate Income Tax’ .

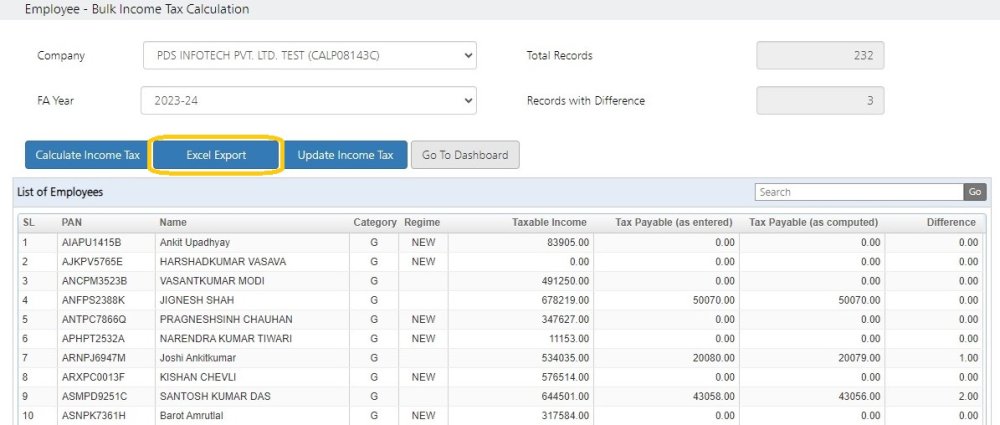

The following screen will get displayed :

The number of records in which there is any difference in the TDs amount entered by the user and calculated by the system will get displayed. In this case there are 3 records with differences. The user has the option to rectify the same.

Click on ‘Excel Export ’. The following screen will get displayed :-

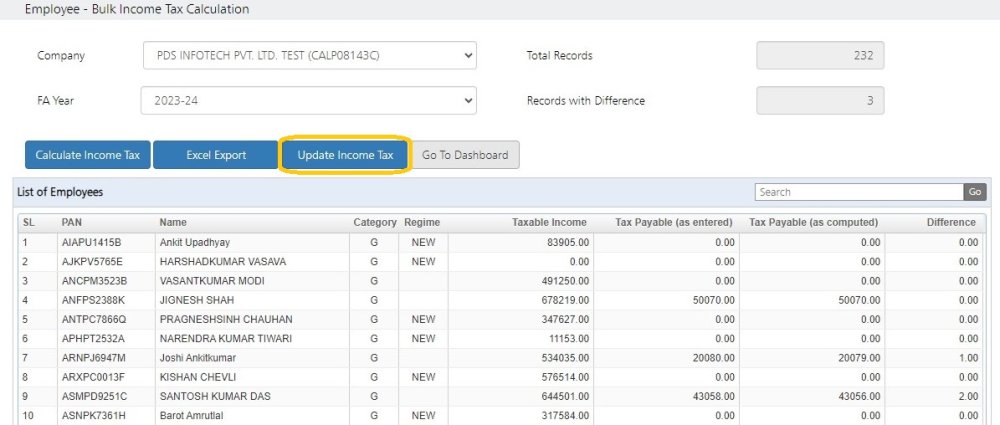

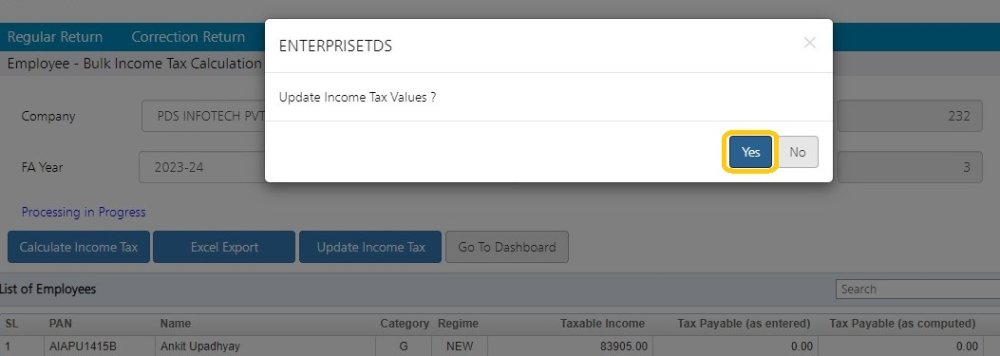

In order to update this data in the system, click on ‘Update Income Tax’ .

The following screen will get displayed :-

Click on ‘Yes’

Need more help with this?

TDSMAN Online - Support