This calculator is a tool that has been provided for computing the tax liability under the Old and New Regimes based on the data that is keyed in on the interface. It is only for the purpose of information and understanding and has no impact on the system data.

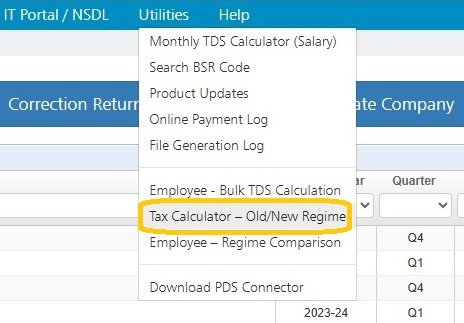

In order to do so click on ‘Utilities’ > ’Tax Calculator – Old/New Regime’, as shown below :-

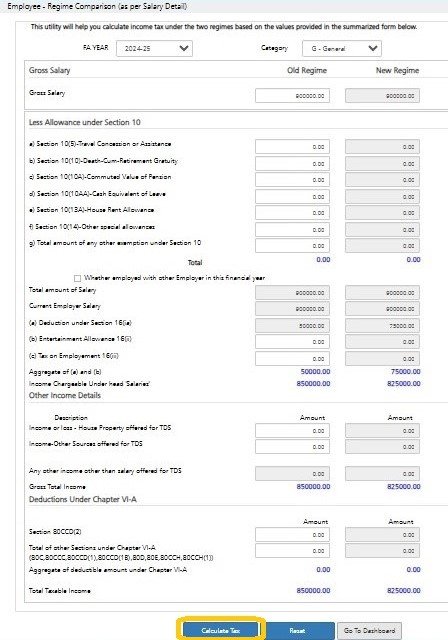

The following screen will get displayed :-

FA Year – Select the Financial Year for which the Tax has to be calculated

Category – Enter the Category i.e. General, Woman, Senior Citizen and Super Senior Citizen

Enter the Gross Salary and other relevant values in the Old Regime. Whatever is applicable for the New Regime will automatically get reflected here.

Click on ‘Calculate Tax’ .

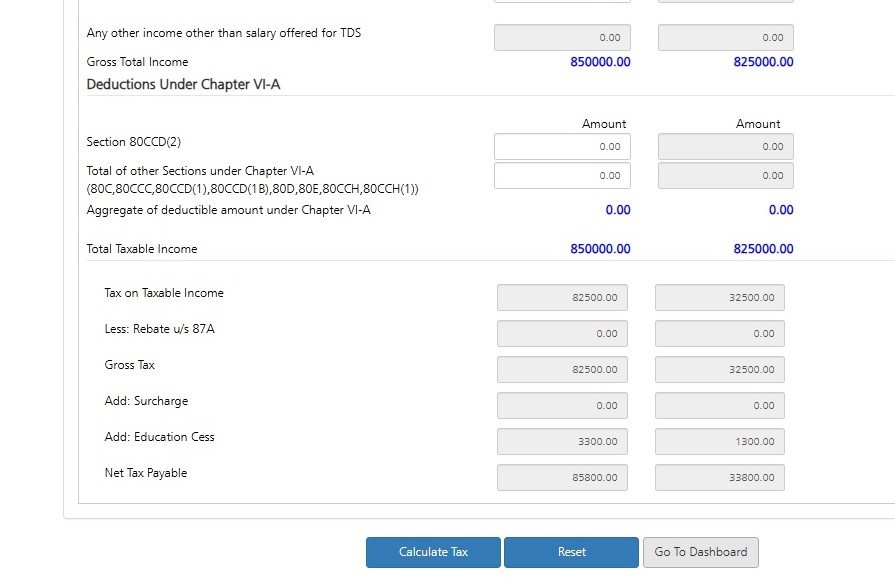

The system will calculate the taxable income and the tax liabilities under the Old and New regimes on the basis of the values provided and the following screen will get displayed :-

Need more help with this?

TDSMAN Online - Support