For making the Correction Return you have to import the file of the last accepted return for the relevant Deductor, Form type, Financial Year & Quarter.

This TDS file can be downloaded from TRACES website after registering your TAN in their website. The URL for the same is www.tdscpc.gov.in .It will have all the details of the latest return that has been uploaded by you. This TDS file will always show your last accepted statement at the Income Tax Department.

Click on Upload Conso File under ‘Correction Returns’ menu from TDSMAN online Dashboard to upload the file in online portal.

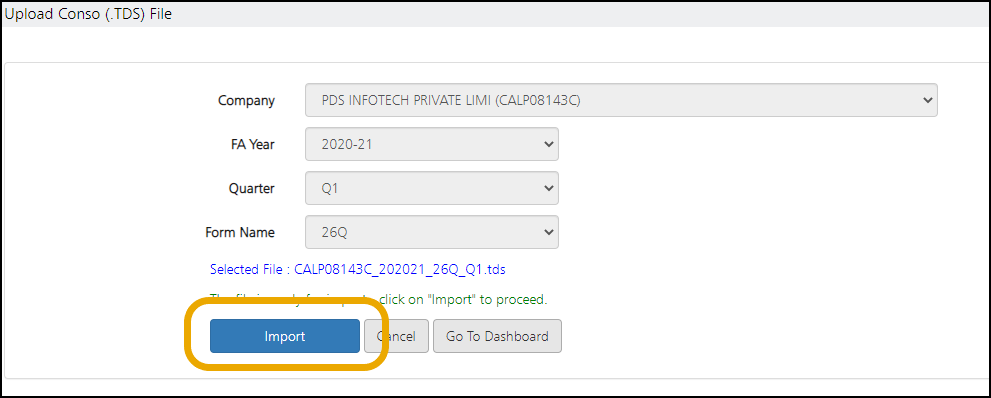

The following is displayed below:

Select the details of the ‘Conso File’ which has to be uploaded

Company: Select the ‘Company’, for which the corrections has to be made

FA Year: Select the ‘Financial Year’

Quarter: Select the ‘Quarter’ of which the TDS corrections needs to be made

Form Name: Select the ‘Form Name’

Then choose the Conso file from the system by clicking on . Once the file is uploaded, click on . After uploading the Conso file, click on as shown above.

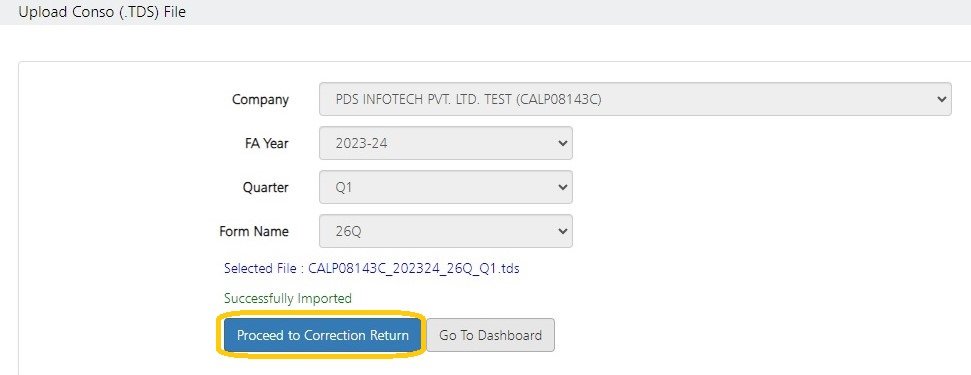

After importing the file, following will get displayed:

Need more help with this?

TDSMAN Online - Support